Tuesday, July 3, 2007

Electronics Charts Auto's Future Course

Penton Media - Automotive Electronics, Click Here!

Until now, the high cost of electronics was a prohibitive factor. However, advances in semiconductor processes and manufacturing technologies have changed that scenario. Coupled with more players in the supply chain, it is helping suppliers to make automotive electronics competitive with consumer electronics and thus, facilitating electronics to permeate every aspect of the auto system.

As multimedia and infotainment products gain popularity, the OEMs also have stepped up the focus on occupant safety. While earlier designs have made significant progress in protecting the driver and the passengers, automobiles are still prone to collisions and crashes. Hence, automakers, in conjunction with electronics suppliers, are developing a new generation of safety technologies, such as blind spot detection, collision avoidance, adaptive cruise control, and pre-crash sensing systems. Interestingly, as the auto industry readies these occupant safety technologies, the government has taken a wise step. To help stimulate the adoption of intelligent vehicle sensing and control systems in U.S.-sold vehicles, the U.S. House of Representatives recently proposed a new law, Intelligent Vehicle Highway Safety Act of 2004, according to a new study by ABI Research. The ABI Research report suggests that such government support will spur the adoption of these technologies despite their initial high cost.

Because such anticipatory systems will deploy sensors, proprietary algorithms, and high-speed communications to interact with other system functions in this integrated methodology, the role of system software will grow significantly. Concurrently, these electronic controls and systems are entering the new digital era. Unlike the conventional analog approach, the new solutions are also reaping the benefits of microprocessors and digital signal processors (DSPs) to transform the modern car into an interactive vehicle system of the future. While the smart digital control will allow functions such as brakes, steering, powertrain, and similar other vehicle subsystems to interact, this intelligent digital control system will permit the motorist to interact with gadgets like PDAs, cell phones and the Internet. In short, digital electronics is converting the conventional automobile into a smart environment wherein human-to-machine interface (HMI) begins to play an important role.

This further emphasizes the importance of software in forthcoming models. Like computers, software is ready to play a key role in upgrading your car's functionality and features. As the new electronic revolution sets the stage for plug-and-play and interoperable components, it will also help bring down the number of microcontroller units in future cars. Toward that end, German automakers and electronics suppliers have formed a consortium that intends to put a standard software vehicle infrastructure on the road by 2006.

This spate of activity is spurring the growth of electronic and semiconductor content in today's average vehicle. As a result, the auto electronics market is growing at an impressive pace.

In essence, as mechanical and electromechanical methods give way to electrical and electronic technologies, novel vehicle architectures are being developed to further accelerate this transformation. Unlike traditional bottom-up architecture, a top-down engineering approach is under way wherein models, simulation, and analysis will be integral parts of the design flow.

http://autoelectronics.com/infotainment/consumer_electronics/electronics_charts_autos/

Emerging Vehicle Technologies and Services

Penton Media - Automotive Electronics, Click Here!

Another attribute that is undergoing a metamorphosis is automotive security. There is nothing new about locking cars but transforming the locking function into a service that is human-centered is a new opportunity. Who wouldn't mind a car that automatically locked and unlocked itself upon recognizing you?

As an industry, we face challenges in addressing the emerging automotive infotainment and security needs, but we also have an ocean of opportunities ahead of us. The consumer is in for exciting times — plug and play entertainment in the form of portable audio, video, games and text on demand — wirelessly downloadable; navigation systems, real-time traffic and other roadside information — all upgradeable over the ownership duration of a vehicle.

What is stopping the automotive industry from delivering on this convergence of information, entertainment and security systems? There are two significant challenges: One is the technology and the other involves the processes. As we take an end-to-end view, beginning with system creation, and progressing to design, development, manufacturing, assembly, sales and life-cycle management, one sees the gaps in technologies and processes that need to be filled in order to make the delivery of infotainment systems viable.

Even if the component technologies such as an MP3 player or a hand-held navigation system are ready, the system technologies such as an integrated solution that allows an MP3 player and navigation units to cohabit and share the interior “utilities” of the vehicle, are yet to mature. The utilities include power supply, input and output devices such as buttons, knobs, sliders, loudspeakers and video displays. These system technologies are software intense and demand a redesign of software systems and tools for requirements capture, modeling, verification, validation, testing, bundling, deployment, maintenance and upgrade. Other than in the powertrain function where software has been designed and written in-house by many of the major carmakers, software as an entity in its own right is a relative newcomer in the automotive industry, which has traditionally viewed automotive components in terms of hardware modules.

From a process standpoint, infotainment and emerging security components demand fast development cycles to match the relatively short life periods, about 18 months, of their associated technologies, compared to the 120 months for an automobile. If the infotainment specifications are created 60 months in advance, their features will be obsolete when the vehicles reach the showroom. Even if one manages to create the specifications in time for production, the challenge is not over because one must have the means of supporting late-stage customization and updating features as they “age” over the ownership of the vehicle. The industry has recognized this and is working pre-competitively and competitively in several ways.

Examples of pre-competitive collaborations include the Automotive Open System Architecture (AUTOSAR) development partnership, the Open Services Gateway Initiative (OSGi) alliance and the Automotive Multimedia Interface Collaboration or AMI-C. Over the past two years there have been several products and concepts — BMW's iDrive™-based products, Lincoln's “Wi-Fi” Aviator concept — that are beginning to manifest the emerging product value of the convergence of infotainment and security technologies.

As a consumer-driven industry, we'll do what it takes to find the answers to deliver the products and services that help our customers better manage and enjoy their driving experience.

ABOUT THE AUTHOR

K. Venkatesh Prasad is the founding leader of Ford Motor Company's Infotronics Technologies Group — a globally distributed activity the company established in 1998, within the Ford Research and Advanced Engineering Organization. Prasad is responsible for the research and accelerated development of a broad spectrum of end-to-end communications and in-vehicle computing technologies.

Automotive Electronics Spurs Semiconductor Growth

Penton Media - Automotive Electronics, Click Here!

Because there is pressure to implement emerging advanced automotive safety, engine, infotainment, chassis control, and wireless technologies, analysts predict this decade will witness an unprecedented growth in automobile electronics content. This growth in automotive electronics is spurring demand for a new generation of semiconductor devices. Analysts at ABI Research believe that differing requirements around the world are driving growth for automotive-specific semiconductors. In Europe and Asia, for example, smaller engines are the norm and there is a defined need to match their performance with larger displacement engines. To maximize the performance of these smaller engines, advanced engine management technologies including displacement on demand (DoD), variable valve timing (VVT), and direct fuel injection are being aggressively rolled out in these regions.

The same is happening in the United States, although predominantly due to rising fuel costs and emission standards. New government legislation mandates that automakers must implement advanced airbag safety systems and tire pressure-monitoring systems into future car lines. Consequently, automotive processors are proliferating. The evolution of microcontroller and sensor technology is allowing OEMs to create systems that can provide levels of vehicle control and safety unheard of 10 years ago. A study from ABI Research, “Automotive Electronics Systems: Market Requirements for Microcontrollers, Accelerometers, Hall-effect and Pressure Sensors,” shows that ever-tightening emissions standards and taxes on vehicles with poor fuel economy are indirectly resulting in a surge from engine management systems based on 16-bit processors, to designs based on 32-bit architectures. ABI Research analyst Robert LaGuerra said, “We believe engine management systems will go to a 32-bit processor architecture as a result of stringent emissions standards and higher taxes on vehicles with poor fuel efficiency.” For the engine to burn as efficiently as possible additional sensors and processing power must be added to obtain more accurate control of fuel supply, spark and emissions. That demands the use of 32-bit systems. Emerging countries will still be able to use 16-bit, but by the end of the study's forecast period in 2010, nearly all engines in the United States will be using 32-bit microcontrollers. Additionally, emergence of onboard cameras, as well as occupant detection as part of next-generation airbag systems will be driving the growth of semiconductor devices and associated components to new heights as well.

Likewise, general purpose and optimized DSP processors are finding use in digital radio broadcasts, high-quality audio, mobile TV reception, and telematic applications in the automobile arena. Transition from conventional combustion engines to hybrid electric vehicles is creating demand for a new generation of power semiconductor devices. Migration to solid-state lamps is fueling growth in power ICs.

Proliferation of these high-performance semiconductor devices, power management solutions and electronic components has attracted companies like Fairchild Semiconductor, Maxim Integrated Products, Linear Technology Corp., National Semiconductor Corp., Micrel Semiconductor and Texas Instruments who have created automotive groups to tap this growing pie. Even FPGA makers like Xilinx see a need for FPGAs in tomorrow's automotives and are going after this market. Just as PCs crafted a new market for semiconductor devices in the 1980s, and mobile handsets in the 1990s, automobiles offer new opportunities this decade.

http://autoelectronics.com/infotainment/consumer_electronics/automotive_electronics_spurs/

Portable Entertainment and Information in the Car

Penton Media - Automotive Electronics, Click Here!

The challenge with this growth, however, is to ensure that consumers are able to safely and efficiently use portable entertainment devices in their cars. The basic requirements for this are:

1. Guaranteeing the safe and secure installation of the portable device in the car.

2. Giving the ability to use content from the portable device in the car's built-in sound system and video display, providing an enhanced user experience.

3. Powering or recharging the portable device while mounted in the car.

4. Enabling device control from the steering column, center console or dashboard.

Portable devices are no longer used just as players; they can store personal data inside. The latest audio jukeboxes, for example, are equipped with hard drives with enough storage capacity to house most people's entire music collections, an array of pictures, and still have room to spare. This is one reason the use of portable devices in the car will become increasingly compelling.

New features to ensure the safe use of devices in the car is another reason for the growth in consumer demand. The control of entertainment and information can be transferred easily from the device's user interface (UI) to the car's UI. Universal plug and play (UPnP) and digital living network alliance (DLNA) formats have made the mappings between device and content more seamless.

Thanks to aftermarket suppliers, drivers and passengers have more devices at their disposal. However, aftermarket equipment often does not meet the rigorous full-range performance, reliability and quality specifications required of OEMs. In addition, aftermarket car equipment makers are not subject to the same safety concerns. If a user chooses to misuse aftermarket equipment while in the car — like watching a DVD while driving — they are personally accountable for their actions. On the other hand, if a vehicle's design allows for the misuse of infotainment devices, then the vehicle manufacturer may be held liable for users' safety.

Car manufacturers are also doing their part in advancing the user experience within the car. Today's cars are rolling off production lines with hard disks installed in them, primarily to provide map storage for built-in navigation systems, as well as to store music files.

In an ideal world, for seamless access to their music or video content, users should have the ability to synchronize their portable device to the car's hard disk drive. Looking ahead, there is the possibility of synchronizing the car's hard disk drive through direct connections to the Internet or indirect connections via a user's in-home digital network.

In the near future, Wi-Fi connections will allow cars to synchronize while they are parked in the owner's driveway or in a public Wi-Fi “hot spot,” enabling the seamless management of digital entertainment. Services such as Mobile Worldwide Interoperability for Microwave Access (WiMAX) promise to provide cars with broadband Internet connections while on the move, further expanding consumers' ability to benefit from portable entertainment and information in the car.

ABOUT THE AUTHOR

Jack Morgan is a senior director, automotive marketing and sales, for North America, Philips Semiconductors. He brings more than 31 years of experience in the automotive industry to Philips. Morgan graduated from Arizona State University with a Bachelor of Science in Electrical Engineering. He holds two U.S. patents in fuel pump control and power converters, respectively.

New Features, Lower Costs for Automotive Multimedia

Faced with rapidly falling prices and the need for integrated solutions, suppliers of automotive multimedia products and services are forming partnerships in hopes of gaining metaphorical high ground in a market with enormous potential.

“The prices of consumer electronic products have been dropping and the same is true for automotive multimedia,” said Mark Peters, who heads the automotive multimedia business at Robert Bosch Corporation.

“OEMs have seen price reductions of 30% to 40% in the past two or three years for both radios and navigation systems,” said Peters. “Products that were stand-alone are now being integrated with other products. Today, for example, satellite radios require a separate tuner, but in next-generation systems, satellite tuners are being integrated with radio/CD head units. The same is true for HD radio.”

Peters added that integration is occurring in rear seat entertainment systems. “Some OEMs are including a DVD drive in their head unit so that someone in the front seat can control content delivered to monitors in the rear, while other OEMs prefer to install a DVD player in the rear seat area,” he noted. Bosch's Blaupunkt unit has integrated a DVD player with a navigation system for Volkswagen's Taurig, Jetta and Passat models.

Growth areas for automotive multimedia include satellite radio, rear-seat video, and navigation, according to Robert Schumacher, business line executive for integrated media systems at Delphi Automotive Systems.

“As recently as 2000, the best available multimedia technology was AM/FM radio and a CD,” he said. Now, Delphi and other tier-one suppliers are integrating entertainment with data and productivity applications, the latter including navigation and telematics.

“Navigation is growing rapidly in North America, following Europe and Japan,” Schumacher said. “Lots of people in North America may say they don't need navigation because of the grid patterns common to many cities, unlike Europe and Japan, But what will really drive navigation will be the integration of live traffic information. It's penetrating luxury vehicles at a high rate and moving into medium-size vehicles.”

Schumacher noted that drivers in North America can hear traffic reports on the radio; however, the information they hear is often so old that by the time a driver gets to a reported trouble spot, the accident or stalled vehicle has been cleared.

NAVTEQ aggregates traffic data from multiple sources, including commercial traffic data providers, government departments of transportation, police and emergency services, road sensors, cameras, and airborne reports. It tracks planned incidents such as highway construction, unplanned incidents such as accidents and disabled vehicles, and traffic speed. The data is then linked to a local map for wireless delivery to a navigation system.

Partnering with NAVTEQ, Sirius Satellite Radio late last month introduced real-time traffic data service in 22 metropolitan areas. Initially, the service will be available via the SiriusConnect SIR-ALP10T tuner, which interfaces with Alpine Electronics' NVE-N872A Satellite Traffic Ready navigation system.

Rival satellite service provider XM Radio, also paired up with NAVTEQ, launched its real-time traffic service last fall. It's currently available on the Acura RL and Cadillac CTS, and user feedback is positive, according to Paul Kirsch, XM's vice president, OEM. Three more OEMs intend to offer the service within the next 12 months, Kirsch said. Real-time traffic is expected to be available in 50 metro areas by 2007, and coverage will be expanded within the metro areas where the service is currently available.

“Users can program their destination on a touch panel, and with real-time traffic, the computer can calculate the shortest route to a destination based on actual traffic conditions,” Schumacher explained, adding that Delphi has sold more than six million XM Radio receivers.

Aftermarket systems will play a role in the evolution of automotive navigation. Cobra Electronics last month introduced the NAV ONE 4500, a portable device that features real-time traffic. Cobra is partnering with Clear Channel Radio and Tele Atlas and provides information on traffic incidents, congested roads and construction zones in 48 metropolitan areas. The system's receiver obtains continuously updated traffic data through a FM radio feed via Tele Atlas and Clear Channel Radio's Total Traffic Network.

“The key to the navigation market is to keep driving costs down,” Schumacher continued. “A system may have a large color display, a map database, a fairly powerful onboard computer, and memory to process the data. We can take some of the cost out and still provide navigation. We're looking at lower-cost navigation solutions such as smaller displays, and smaller databases. We could have a smaller monochrome display with passive LCD. We could provide turn-by-turn directions vs. displaying routes on a map, and we could move the map database offboard.”

Smaller display screens won't fly as high in the rear seat entertainment (RSE) category. Screens are increasing in size and number, according to Schumacher. In a recent survey, J.D. Power and Associates ranked Panasonic's RSE system for the Lexus GX 470 first in customer satisfaction. According to the survey, more than half of current RSE owners want RSE in the next vehicle they buy.

While Panasonic still dominates the market, several other manufacturers are entering the arena with their own rear-seat entertainment systems, fully equipped with innovative features, according to Lawrence Wu, J.D. Powers' senior director of automotive emerging technologies.

“New to the market is the nine-inch screen on the Honda Odyssey's RSE system. Honda's decision to equip the Odyssey with the largest screen available is a hit with consumers,” Wu said. “Given that almost two-thirds of consumers in the study are willing to pay for a larger screen size, we expect to see others following Honda's lead.”

Wu added that nine out of 10 RSE system owners would rather have wireless headphones, independent volume adjustment and system controls in the rear seat area in their next vehicle. More than one-half of consumers also report that they or their passengers use the headphones for the radio or CDs. Along with wireless headphones, built-in monitors in headrests are also high in consumer demand. Almost half of RSE owners consider a remote control to be the best method for operating the system.

“Content today comes in on a CD or DVD disk,” he said. “With the advent of WiFi and the use of hard drives, which are already being used in Japan, entertainment or navigation content can be brought in through the head unit. Music, games and software can be delivered directly into a vehicle over high-speed Internet without ever pressing a plastic disk. It can be downloaded to a car, stored in a hard drive and played back.”

Schumacher predicted that someday a user may be able to drive into a gas station and fill up his or her “bit tank” — a hard disk drive — buying virtual CDs or renting movies. Partnering with Comcast, Delphi demonstrated that capability at the Consumer Electronics Show in January.

Delphi has also demonstrated streaming video to vehicles with both XM and Sirius. “Ultimately, XM and Sirius are going to be more than music and talk,” Schumacher said. “They provide a low cost way to push individually targeted data to vehicles. It's the perfect infrastructure for national broadcast video. It's not HDTV; high resolution isn't needed on a seven- or eight-inch screen for news, weather, cartoon channels and movies.”

“Our vision for the future is any entertainment, anytime, anywhere: WiFi, streaming video over satellite digital audio radio service (SDARS), or small files over a 3G cell phone. What makes all this possible are advances in portable hard drives, digital file compression, and wireless infrastructures.”

Earlier this year Delphi signed an agreement with WorldSpace to make mobile satellite radio available in Asia for the first time. The companies will market Delphi-WorldSpace Mobile Satellite Audio receivers in India, and later in China. The WorldSpace satellite radio network currently provides more than 35 radio stations across India broadcasting news, sports, music, brand name content and education programming

XM Radio's Kirsch said that most of the technology needed to achieve the any time/anywhere vision is available today and can be deployed wherever an OEM develops a business case.

OEMs must also consider connectivity for consumer electronic devices and data, including music, and addresses for navigation systems, said Bosch's Peters. “This could be in the form of .mp3 files on a CD, or music or data files on a USB stick, in a PDA or other Bluetooth-compatible device, or in a hard drive product like the iPod,” he said. “Consumers will want to carry files from their home to their vehicle. For that purpose, we're starting to look at FireWire, because of its wide bandwidth, but right now there are some electromagnetic compatibility (EMC) issues.”

SEMICONDUCTOR SOLUTIONS

Semiconductor firms are targeting automotive multimedia applications. Renesas Technology America Inc., for example, recently introduced four 32-bit SH7261 series microcontrollers for car and home audio products (Figure 1). Because the MCUs have audio data playback functions compatible with MP3, WMA and AAC compression standards, and can replace the system controller and the DSP and LSI chips traditionally required for digital audio processing, the powerful SuperH RISC devices simplify system design. Based on a CPU core with a built-in floating-point unit, the chips execute two instructions per clock cycle for higher performance per operating frequency. Each device features an on-chip CD-ROM decoder and a dual-channel serial sound interface. To shorten product development time and enhance system versatility, the new RISC MCUs accommodate middleware for various audio formats (MP3, WMA, AAC, etc.). Also, their high levels of processing allow coder-decoders to be implemented in software.

Among NEC Electronics America's multimedia offerings are satellite radio, rear-seat DVD systems and display interfaces. The company's V850ES/Sx series of 32-bit microcontrollers are optimized for audio applications through the use of anti-EMI techniques that are said to provide heightened audio fidelity and optimized internal circuitry to deliver low-power operation.

Targeting automotive audio applications that require interdevice connectivity, Freescale Semiconductor's 32-bit SCF5250 processor, recently enhanced with additional software libraries, supports CD and HDD-based systems (Figure 2). The chip is based on a ColdFire core with an enhanced multiply and accumulate (EMAC) unit that's said to improve performance and code density for both control code and signal processing in compressed audio decode, file management, and system control. The chip offers more than 107 Dhrystone 2.1 MIPS at 120 MHz performance, and can do the work of both an MCU and a DSP in some applications.

“People increasingly want to have the same entertainment choices in their cars as they have on their portable devices and at home,” said Joanne Blight, director, automotive practice at Strategy Analytics research and consultant firm. “Single-platform technologies that support an easy interface between car and portable devices will be key to meeting both consumer and automotive requirements.”

Analog Devices Inc. last fall demonstrated a rear-seat display chipset on a video display node for the media oriented system transport (MOST) bus. The chipset, based on the firm's Blackfin technology, is a programmable multiformat video output and display system that decodes VDM video streams and MPEG-2 system streams (PS/TS) at full resolution and frame rate. It decodes local audio for headphones and central audio with audio amplifier. A Blackfin in-vehicle entertainment (iVE) platform reference design for an RSE system features a hard disk-based automotive “jukebox” with 32-bit audio processing and support for a variety of multichannel decoders including Dolby Digital, DTS, SRS WOW XT, Microsoft WMA and MP3 playback.

For navigation applications, Atmel's Antaris chipset, developed with u-blox, features a 16-channel architecture that's said to enable fast time-to-first fix figures, increased sensitivity, and faster position tracking. The chipset, consisting of the ATR0600 RF receiver IC, ATR0610 LNA and ATR0620 baseband IC, consumes as little as 100 mW. The chipset is also said to provide excellent jamming immunity and maximum integration to minimize board space requirements.

“We're already seeing the basis for a multimedia explosion,” said Delphi's Schumacher. “Each platform will evolve to provide more sophisticated features and functions as well as to transfer incredible amounts of data. Consumer demand for this continues to be amazing. People are realizing what consumer electronics can do to make their lives more entertaining and productive. People are spending more time on the road and are becoming more demanding about the technology in their vehicles.”

ABOUT THE AUTHOR

John Day writes regularly about automotive electronics and other technology topics. He holds a BA degree in liberal arts from Northeastern University and an MA in journalism from Penn State. He is based in Michigan and can be reached at jhday12@sbcglobal.net.

Driving Next-Generation Digital Head Units for Automotive Applications

The cost pressures and the competition for valuable vehicle center-stack real estate has taken a toll on entry-level head unit suppliers, but customers are willing to pay a premium for higher-end car head units. Suppliers who offer a common platform with a scalable portfolio of basic to premium features enable reuse of designs across product lines, reducing development costs and allowing dedication of resources on more advanced applications.

TECHNOLOGY CONVERSION

Digital technology is replacing analog components in automotive radios, substantially lowering equipment costs and providing added benefits to the listener and broadcaster. Programmable digital signal processing (DSP) technology has been used in radio head unit reception and audio-processing paths for some time. DSPs have eliminated the need for costly, high-performance analog components, improved the quality of broadcast radio through advanced digital reception techniques, and eased radio system design by shifting product development from a rigid hardware design to a flexible software environment.

Considering the lengthy automotive product development cycle and the rapid adoption of new digital media technologies outside of the vehicle, it is difficult for automotive planners to forecast what media features will be in demand by the time products go to production. Perhaps the most important benefit of moving to a software-configurable digital architecture is the relative ease with which new features and functions can be introduced to entertainment and radio head units. The introduction of digital content — such as MP3 and Windows Media Audio (WMA) compressed audio files — has expanded the most basic set of features users expect of their CD-playing car radios. For example, MP3 playback support is becoming a standard item for many head units, just as video and speech applications will be in the coming years. As the amount of digital content continues to grow and the types of digital storage and media formats proliferate, car entertainment systems need increasing flexibility to handle such diverse content sources.

CRITICAL SCALABILITY

Scalability plays a critical role in automotive radio applications. The downward market cost pressures and fierce competition for the valuable vehicle center-stack real estate has eroded profitability for entry-level radio suppliers. However, establishing a position for basic functionality opens the door for supplying more profitable systems with enhanced features. Compelling, enhanced functionality encourages customers to pay a premium for higher-end car head units. Suppliers who deliver a common platform, whose features scale from basic to premium, can then benefit from the level of hardware and software development effort that can be re-used across their product line.

For example, using the same programmable signal processor resources of the AM/FM DSP, developers can add enhanced audio post-processing, speech-enablement, and compressed audio and/or video decoding depending upon the features required.

The demand for automotive digital multimedia features will increase as consumers become more entrenched in today's “digital lifestyle.” Transferring and playing their personal digital media content from a PC, home set-top box or handheld device is available today and will soon be expected in the car. One example is MP3 playback from a CD-R. Supported first by PCs, DVD players and portables, it is available in today's head units. The next generation of these automotive systems promises to support a multitude of larger mass storage devices — including hard disks, USB and flash drives — thus enabling users to bring in, or potentially store, their entire media collections in their vehicles. This increase in size and number of sources of content, as well as the support of content downloading options, will require increased general purpose processor (GPP) performance.

MEDIA PROCESSING SCALABILITY

Digital media processing re-quires significantly more performance than is available from traditional automotive microcontrollers (MCUs). GPP architectures with enough performance to handle the MCU functions and real-time digital media decoding concurrently are too expensive or power hungry for most car radio applications. Consequently, the architecture of choice for many automotive electronics suppliers is a lighter-weight MCU, providing sufficient baseline capability and augmenting it with a DSP to perform high-performance tasks, such as receiving AM/FM or decoding compressed digital content. Completing the base architecture includes having enough RAM and embedded Flash for each processor (Figure 1), as well as a tuner, media storage controller (e.g., a disk drive, removable Flash, etc.), and possibly a connectivity port, such as USB.

With the rising volume of media-enabled radio applications, semiconductor manufacturers have developed system-on-chip (SoC) devices specifically for radio and entertainment head unit products. These SoCs merge MCU, GPP and DSP functions with application-appropriate peripheral sets and memory configurations onto single chips tailored for multimedia-enabled automotive systems.

Perhaps the most significant benefit of a GPP+DSP dual-core SoC architecture is the ability to scale a baseline design to serve different market segments. SoC families often offer a variety of speed and on-chip memory configurations. Software- compatible SoC devices give product line developers an appealing option to increase the system-processing capacity by exchanging an SoC for a higher-performance member of the same family. This way, developers are able to create a baseline system that scales up from the low end with minimal hardware redesign. Adding new system functions on top of basic functionality can become as simple as new software loads for the GPP and/or DSP.

UNIFORMITY AND PERFORMANCE

To the driver, the most valuable aspect of an automobile entertainment system may be its ability to occupy other passengers during particularly mundane travel. The personalization enabled by the digital lifestyle will drive vehicle passengers to want their specific personal media content, and that applies to the driver, too. Why can't the kids get their music or movies and the driver listen to his or her MP3s, too? What if the same compressed song burned to a CD and thumb-drive didn't play exactly the same? Or, perhaps, it didn't work at all from one of the sources? If a single decoding engine capable of playback from several data sources (CD, HDD, USB, etc.) is used, then, independent of which source, the same file would play back identically. To be worthy of being called an automotive-grade system, some guarantee of uniformity in playback needs to be made. A DSP-based centralized decoding architecture can offer that.

With only a modest amount of additional DSP performance, the centralized decoding architecture can be extended to support the concurrent playback of multiple content sources to several listening/viewing zones. Unlike the home or portable environment, the multisource, multiformat, multizone paradigm is a unique challenge for automobile entertainment systems providers. And, it doesn't have to be solved by bringing additional portable systems into the vehicle.

Increased processing performance also is required to support what may be the simplest model for downloading content to a head unit. In this case, the head unit encodes a CD onto its local drive the first time the disc is played. Functionally, the head unit would appear to play music from the CD. However, internally, it would encode each track into a compressed format, such as MP3 or WMA, as fast as possible and play back the encoded version for the user. If the encoding speed is fast enough, the user experience can be comparable to that of using a CD changer. Compared to MCUs or GPPs, DSPs are particularly well-suited for performing the high-speed encoding of digital audio and video. After the CD has been “imported” to the head unit, the user never needs to insert that CD again to listen to it.

While a feature like this can mirror the home/PC experience and improve the in-vehicle user experience, the technology also can be applied to reduce system cost. Certainly, compressing the audio reduces the cost of storing songs, but the opportunity goes beyond that. For example, using high-speed encoding and enough low-cost non-volatile memory instead of a hard disk, a high warranty return item or the multidisc CD changer, could virtually be replaced at a lower cost and yield greater reliability.

INTEGRATED SYSTEMS: REDUCED SYSTEM COST AND COMPLEXITY

Another advantage of moving to an integrated, system-level, dual-core architecture in a car head unit is a reduction in system complexity and component count. By integrating the required application-specific peripherals on-chip, decreasing the number of power supply buses required and using a unified memory architecture, GPP+DSP dual-core SoC devices offer several opportunities to reduce development costs and bill of material (BOM) costs.

Absorbing the functions of the most common components in automotive entertainment systems is a fairly straightforward strategy for component count and cost reduction. Sufficient on-chip, enhanced audio and video capabilities, as well as popular automotive network interface support, are a must. The challenge for SoC vendors is providing appropriate scale to cover low-cost and high-end systems across the diverse regions of the world. Another challenge with the design is to expand the peripheral set, while maintaining post-integration software re-use without reserving costly additional pins on the package.

An often overlooked benefit of this level of integration is the reduction it enables in power supply buses, routing and complexity. Reducing the number of components on the board generally reduces the amount of current required, as well as simplifies the PCB power routing. The reduction in number of supply rails and the amount of current sourced has a definite, positive impact on the complexity of the system level power supply design.

A GPP+DSP co-processor architecture (Figure 2) requires separate external memory resources for both the GPP and DSP. However, with a dual-core SoC, the entire memory map — internal and external — may be shared by the two cores as shown in Figure 3. The overall system memory footprint can be reduced when code is stored in a single common device and when data structures can be shared between cores by passing pointers to common memory locations. This architecture eliminates superfluous memory allocations and reclaims precious CPU cycles associated with copies and block moves.

Typically, in a two-chip GPP and DSP architecture, each processor has its own dedicated memory. In a typical usage scenario, the MCU handles the communications protocol for networks like controller area network (CAN), and connectivity ports, such as USB. Digital content sources are pre-processed by the GPP and then passed to the DSP for decoding. Any local buffering in the GPP memory that also must be copied to the DSP memory is unnecessary and wasteful of memory and CPU cycles. However, in this two-chip architecture, it is unavoidable.

In contrast, a GPP+DSP SoC architecture can use a shared memory architecture. Digital content sources can be pre-processed by the GPP as before, but upon completion, the DSP is notified and pointed to the location in its own memory map of the data to process. The integrated memory architecture of a dual-core SoC device also eliminates the need for complex communications schemes between cores, reducing software design complexity and potentially decreasing overall memory requirements and system processing latency. The shared memory serves as an efficient communication mechanism between the GPP and DSP cores. The GPP can pre-process and place the incoming data source directly in shared memory without interrupting the DSP. Then, when the DSP is ready, it loads the data from the appropriate buffer. Compared to a GPP with DSP co-processor architecture, the SoC architecture eliminates additional data copies between the cores, thus eliminating superfluous memory allocations and reclaiming precious CPU cycles from block move operations.

Additional cost savings can be gained by unifying and minimizing the non-volatile code storage requirements for each core. Rather than using an independent memory device for each core, a single chip may be used to store code for both processors with one of the cores responsible for booting and loading the other.

As a consequence of sharing internal and external memory, for storage and at run-time, the system will require less overall memory, which may translate to fewer discrete memory devices. This shrinks product size, cost and power consumption. It also simplifies board design and electromagnetic interference (EMI) considerations that arise with high-speed memories.

FLEXIBILITY TO ADAPT

Particularly challenging for automotive OEMs is working within the long design cycles typical of the industry — upward of three years. The mechanisms for encoding, delivering, playing and protecting digital content are still highly volatile, as standards continue to change and new standards arise. Choosing which formats will dominate the market three years from now and designing radios around them is simply too risky a decision at this stage. Additionally, it is probable that these formats will have evolved in that time — new radios offering three year-old technology will not have much user appeal.

For this reason, choosing an architecture with a programmable DSP is critical to keeping car entertainment designs adaptable and up-to-date. Therefore, when a radio head unit is ready to be programmed during production, new features and functions, such as the latest audio formats or connectivity options, can be loaded at that time. Additionally, existing radios in the field can be upgraded as code is enhanced and standards evolve.

By working with companies and in industries that tend to lead with digital technology in consumer electronics, such as the portable media player market, Texas Instruments and its extensive third-party network are able to develop, test and prove emerging consumer electronics standards before the auto-motive industry needs them. In this way, the automotive industry is able to approach head unit design from a functional perspective. Since much of the development and integration required to implement these formats has been completed and proven in other high-volume markets, automotive developers can implement head unit design quickly by leveraging these solutions.

INNOVATIVE INTERACTION

Programmability also gives developers a hedge against changes in consumer habits. For example, the wide range of portable multimedia players continues to stretch how users interact with content. Many audio players now provide image viewing and limited video playback. Speech-recognition system features for in-car command and control capabilities (i.e., “Set temperature to 74 degrees”) dovetail particularly well with the hands-free operation being pursued for built-in navigation systems, Bluetooth cellular phones and entertainment modules. DSPs are particularly useful for echo cancellation, noise reduction and voice feature extraction. The flexibility of this programmable, GPP+DSP architecture also lends it-self to capturing more overall functionality within the vehicle. For example, a radio head unit that can provide hands-free capabilities for controlling the air-conditioning and heating system and tuner also can provide these capabilities to other subsystems within the car by extending the control vocabulary. By using the integrated CAN interface, the SoC enables a rather straight-forward integration of capabilities to the existing car systems.

Dual-core SoC architectures have already proven themselves in many industries by enabling smaller products at a lower cost with less power consumption. Moving to a dual-core SoC architecture from an MCU and DSP architecture actually simplifies design, since the architecture is fundamentally the same system integrated into a single chip. Additionally, developing code for both cores can be completed in a single development environment instead of two separate tool suites. With the introduction of automotive-specific SoC devices such as TI's automotive infotain-ment technology, OEMs will be able to provide a better user experience for reduced cost and higher reliability.

ABOUT THE AUTHOR

Brian Fortman is the worldwide marketing manager for Automotive Infotainment division of Texas Instruments Inc.

As the U.S. economy continues to claw its way out of recession, investment in manufacturing and services is on the rise. Watching the electronic and automation new product releases may give us an insight into the direction of our industry and what these component manufacturers see as growth areas.

Brushless servomotors

Starting off this month's summary, Baldor, known industry-wide for motors and drives, has released a new series of stainless-steel brushless servomotors. The SSBSM Series servomotors are designed to IP67 and for 1,500 psi washdown conditions and can be used in harsh, corrosive food or liquid and high-hygiene environments. They are available in standard and low-inertia models, as well as in five different frame sizes, and provide torque up to 280 lb-in. Baldor Electric Co., P.O. Box 2400, Fort Smith, Ark. 72902; www.baldor.com.

Computers and accessories

B&B Electronics, which offers communication and communication-related products, has released a new universal serial card. Many pieces of equipment require RS232, RS422, or RS485 communication, and current PC technology is moving away from 5-volt to 3.3-volts. B&B's Miport universal serial card allows for configuration between any port type, and by operating at the 5-volt level provides for extended range with RS522 and RS485. Other serial cards in this series are available as well. B&B Electronics, 707 Dayton Rd., Ottawa, Ill. 61350; www.bb-elec.com.

CyberResearch is releasing new CPET single-board computers, the fastest the company has ever offered. Based on a P4 CPU, 800 MHz bus, these single-board PC's come with 256 MB up to 2 GB RAM. Standard connections are two to eight USB 2.0 ports, dual LAN, and a CompactFlash socket. The Pentium 4 series of boards also support hyper-threading, allowing multi-threaded applications to utilize idle segments of the P4 CPU. CyberResearch, Inc., 25 Business Park Dr., Branford, Conn. 06405; www.cyberrresearch.com.

Control components

Wilbrecht Electronics has designed a new series of panel-mount LED's for 120 VAC applications. The LED's come in four different colors-blue, green, red, and yellow-and have brightness levels suitable for daylight applications. A series of mounting hole sizes are available from 0.187 inch to 0.312 inch. Wilbrecht Electronics, Inc., 1400 Energy Park Dr., St. Paul, Minn. 55108; www.wilbrecht.com.

Astec Power, a division of Emerson, has announced the release of a low-profile model 1U, 175-watt quad output power supply suitable for single-board computer, medical, or other applications. These are switching power supplies, accepting 85-264 VAC. The IPQ173 has a small footprint and is only 1.5 inches high. High-current outputs are adjustable from 3.3V to 5.5V. Astec Power, 5810 Van Alien Way, Carlsbad, Calif. 92008; www.astecpower .com.

Also under the power supplies category, but directed toward industrial control panels, Automation Systems Interconnect has introduced new types of switching power supplies in the CSF-10. Specifically designed for industrial use, they can accept input voltage from 120-230 VAC with 24-volt adjustable output. ASI, P.O. Box 1230, Carlisle, Pa. 17013; www.asi-ex.com.

For printed circuit board design, Micro Plastics, Inc., is now offering a square standoff LED mount. The product adds to the company's existing line of circuit board hardware. The LED mount is designed to provide secure mounting for two- and three-lead devices and to protect from heat and shock of vibration. Micro Plastics, Inc., P.O. Box 149, Highway 178 North, Flippin, Ark. 72634; www.microplastics.com.

BK Precision, a recognized name in test equipment, has released its new Model VSP4030, a high-output switching d-c power supply communicating via a RS-232 serial port. The supply is capable of 0-40 VDC at 0-30 amps and has low noise output. The unit can be tuned via the panel-mount ten-turn potentiometer, the RS-232 interface, or a remote analog signal. Units may also be cascaded to produce up to 10 kW of d-c power. BK Precision, 1031 Segovia Circle, Placentia, Calif. 92870; www.bkprecision.com.

Sensing devices

There are only two new sensing devices of note for this issue. First, Macro Sensors of New Jersey is offering a new line of AC/DC-operated linear variable displacement transducers, or LVDT's, for dimensional or positioning information. They can be used for large shaft TIR measurements, metal fabricating, or other automation applications. The GHSAR/GHSDR 750 Series units are constructed entirely of stainless steel and operate in harsh environments. Electronics and coil-windings are hermetically sealed against hostile environments to IP-68 standards. Precision is 0.000025 inches with ±10 volts d-c output designed for PLC applications. Macro Sensors, U.S. Route 130 North, Bldg. 22, Pennsauken, NJ. 08110; www.macrosensors.com.

LMI Technologies has introduced a new series of single-point laser sensors designed for thickness measurement, profiling, and positioning. These units, the DLS-2000 line of laser displacement sensors, are also lower in cost than comparable sensors, according to LMI. Offset distance from the sensor can be 4.0, 10.0, or 19.7 inches, with sensing range measurement maximums of 11.8, 24, or 188 inches and deliver a 25-micron resolution. The sensors offer RS-232 and RS-485 interface, as well as 0-10 VDC or 4-20 mA analog outputs. LMI Technologies, 21455 Melrose Ave., Suite 22, Southfield, Mich. 48075; www.lmint .com.

And finally this month, in our "most interesting" category, Electronics Workbench has introduced programming and simulation software, Multisim 8, designed to do simulation for electronic circuits. It allows for capture of repetitive tasks so that the designer can be more free to create. Using Tektronix Virtual Instruments, Multisim 8 allows for dynamic probes to be inserted into the circuit design to show a simulation of circuit performance. An unlimited number of probes can be programmed. Further design notes and annotation can be inserted into the tests and saved. This software is intended for concepting and simulation of a design and can be integrated with board layout and other system simulations. Electronics Workbench, 60 Industrial Park #068, Cheektowaga, N.Y. 14227; www.electronicsworkbench.com.

http://findarticles.com/p/articles/mi_qa3726/is_200502/ai_n9520793

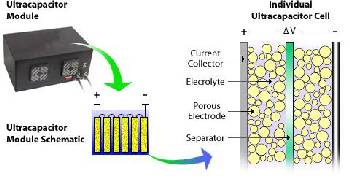

What Are Ultracapacitors

Find out about ultracapacitors - how they work and what they are used for.

Ultracapacitors (sometimes called double-layer capacitors or supercapacitors) store energy electrostatically by polarising an electrolytic solution. Unlike batteries no chemical reaction takes place when energy is being stored or discharged and so ultracapacitors can go through hundreds of thousands of charging cycles with no degredation.

Ultracapacitors are currently being developed all over the world for use as a potential alternative to chemical batteries. One area of particularly concentrated research is in developing ultracapacitors for electric vehicles - such as the EEStor Ultracapacitors which will be powering Zenn electric vehicles by the end of 2007.

Commercial Uses for Ultracapacitors

There are many commercial uses for ultracapacitors of all sizes - from multi-kWh electric vehicle power systems down to tiny back-up power sources for electronic devices. Ultracapacitors can provide a pulse of energy far more efficiently than chemical batteries or a power supply, and so they are often used in tandem with standard batteries to provide such energy pulses when required and also to act as a back-up power source should the batteries fail.

Pictured above is a commercially available ultracapacitor promising 500,000 duty cycles and a 10 year life. This Maxwell BCAP0140 is the same size as a C-type cell battery and would typically be used in tandem with C-sized batteries.

Even if ultracapacitors turn out not to be suitable for use as electric vehicle power systems, many manufacturers of hybrid vehicles are looking at using ultracapacitors to capture deceleration and braking energy which can then be discharged quickly later on to boost acceleration and to start the engine.

Car manufacturer Honda have independently developed a 9.2 Farad ultracapacitor system to act as supplementary power for the Honda FCX hydrogen fuel cell powered car.

http://www.reuk.co.uk/What-Are-Ultracapacitors.htm

Solar Charge Controller

Find out more about Solar Charge Controllers

A Solar Charge Controller (or Regulator) is a device which protects the batteries in a solar electric system from being overcharged or being over-discharged. Overcharged batteries have a much shorter life time than well cared for batteries since the electolyte is boiled off as gas and lost. Overly discharged (i.e. flat) lead acid batteries are damaged permanently and so the solar charge controller is used to disconnect any load when the battery is running low to prevent the batteries getting too low.A charge controller is not always required if the maximum current going into the battery is more than 10% of the batteries Ah capacity - i.e. if the battery is 60Ah then a charge controller is certainly required if the current from the solar panel is likely to exceed 6 Amps - as long as you make sure you don't over-discharge the battery. Some suggest a charge controller is required if the maximum current from the solar panel is just 1% o f the Ah capacity of the battery bank.

Well known manufacturers of solar charge controllers include: BZ Products, Iota, Morningstar, Outback, RV Power Products, ProStar, Solar Converters, Statpower/Xantrex,Trace/Xantrex. Prices range from around £15 to many hundreds of pounds depending on the size of the solar power system to be regulated and the features of the controller. For example, pictured below is a Sunguard solar charge controller for small PV solar power systems (up to 4.5A at 12V) which costs around £25.

LEDs and (in the more expensive regulators) LCD displays are used to show the current state of the charge of the battery, the state of the current entering the batteries from the solar panel(s), and the current being drawn from the battery by loads.

http://www.reuk.co.uk/Solar-Charge-Controller.htm

Grid Tie Inverters

For a brief summary of power inverters and their use in a renewable energy systemIntroduction to Inverters.

If you have a small scale renewable energy set up - for example, just a micro wind turbine or a few PV solar panels, then you will almost certainly be using battery storage rather than tying into the National Grid. In those cases there are very many suitable inverters ranging from just £10 to many £hundreds depending on your exact needs. If however you wish to connect your wind turbines and/or solar panels to the National Grid, you will need a Grid-tie Inverter - particularly if you intend to sell (export) electricity back to the utility company.

please read our

Grid-Tie Inverters (plug in type)

Not all grid-tie inverters operate in the same way. In general a grid tie inverter needs to be wired directly into your home electric circuit by a qualified electrician. However a simpler alternative been on the rise recently - an inverter which you simply plug into a home ring main using a standard three pin plug. This is exactly the type of power inverter provided with the popular Windsave 1000 wind turbine from B & Q.If for example you have a laptop computer and a desk lamp drawing around 150 Watts between them, and a solar panel generaing 200 Watts which is plugged into the same ring main using a plug-in inverter, then the laptop and lamp would be powered entirely by your solar panel and any excess power would be lost to the National Grid. If you only had a 100 Watt solar panel, then its power would be supplemented by the National Grid (and you would have to pay for the extra electricity used).

If you have a small DIY renewable energy set up, then a plug in inverter such as the Mastervolt Soladin 120 pictured above is a good starting point. This tiny plug-in inverter will accept up to 2.8A and 50V DC with a nominal power output of up to 90 Watts. It converts the DC into 230 VAC at 90+% efficiency. (12V solar panels would have to be put in series to generate 24 Volts since the voltage range for this inverter starts at 24 VDC.) It is priced at around £100.

Grid-Tie Inverters

Grid-tie inverters are generally one of the most expensive components of a renewable energy generation system. Typically prices start from at least £500, but prices are falling as the technology improves.Manufacturers of quality grid-tie inverters include: ExelTech, Fronius, Magnum Energy, Morningstar, Outback, SMA, Solectria, and Xantrex.

Probably the most popular are the Sunny Boy series of grid connecting inverters from SMA - a German company specialising in inverters for solar generating applications. All Sunny Boy inverters comply with UK G83 grid connection regulations, have efficiencies of over 93%, and have an estimated lifetime of over 20 years.

The SB700 is available in the UK for around £800 offering up to 700 Watts of power. Much larger applications could be served with an SB3000 or SB6000 inverter for powers of up to 3000 (£1500) and 6000 Watts (£2500) respectively. And of course there are Sunny Boy's with many other power outputs within that range.

http://www.reuk.co.uk/Grid-Tie-Inverters.htm